|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

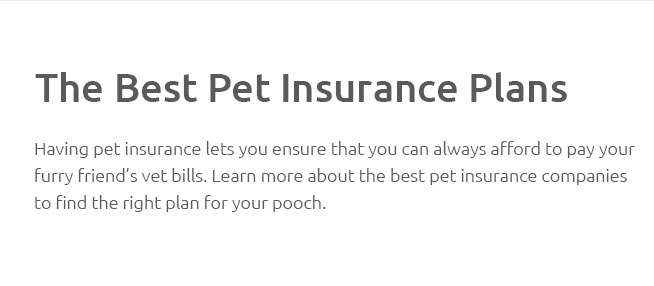

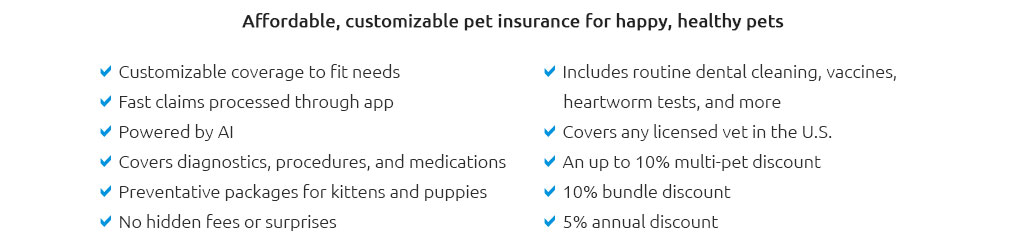

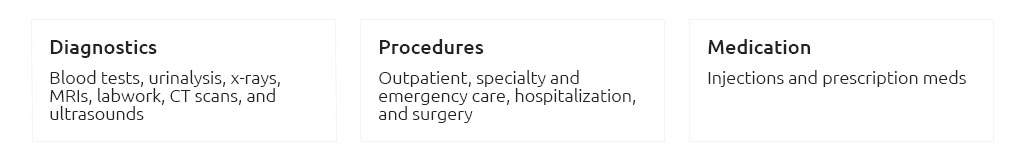

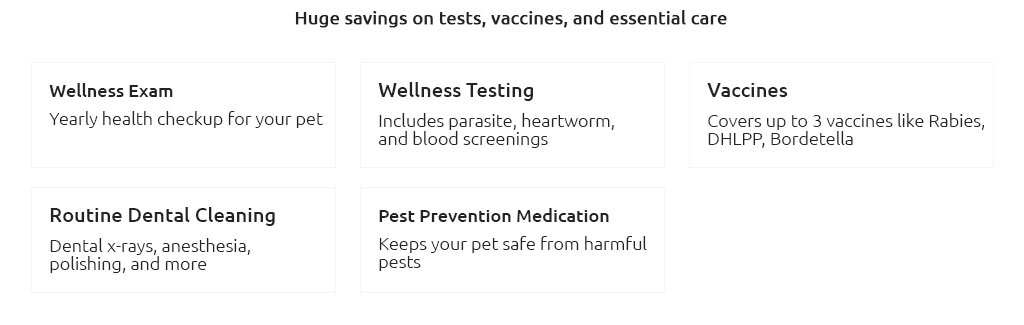

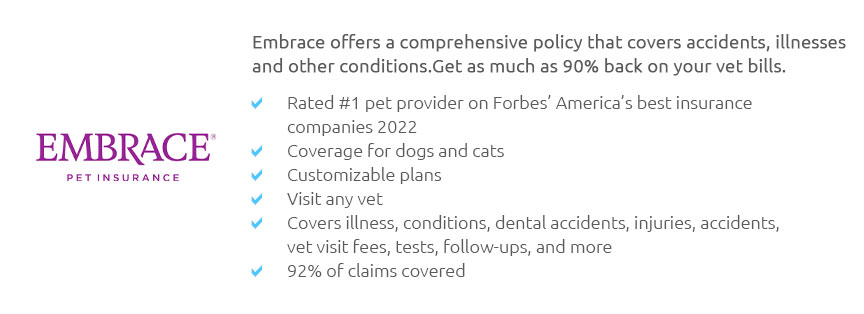

Affordable Pet Insurance: Weighing the OptionsIn today's world, where the cost of veterinary care continues to rise, pet insurance is increasingly becoming a necessity rather than a luxury. Affordable pet insurance is a topic of great interest to many pet owners, as it offers a potential safety net against unforeseen veterinary expenses. But is it really worth the investment? This article delves into the nuances of affordable pet insurance, exploring the benefits, potential drawbacks, and key considerations when selecting a plan. To start with, what exactly is pet insurance? At its core, pet insurance is a policy that helps cover the cost of veterinary treatment for your pets, much like health insurance does for humans. Policies can vary widely, with some covering accidents and illnesses, while others might include wellness checks and preventive care. The affordability of these policies largely depends on the level of coverage, the provider, and, of course, the specifics of your pet's breed, age, and health status. One of the most significant advantages of affordable pet insurance is the peace of mind it offers. Knowing that you're financially prepared for any health emergencies can alleviate the stress that comes with owning a pet. Additionally, many plans allow you to choose your veterinarian, ensuring that your pet receives the best possible care without the limitations of a network. However, it's important to consider the potential downsides as well. Some policies come with high deductibles, co-pays, or caps on payouts, which can limit the financial relief they offer. Furthermore, pre-existing conditions are often excluded, making it crucial to enroll your pet while they're still young and healthy to maximize benefits. The fine print of any policy deserves careful scrutiny to avoid unexpected surprises. When searching for the right pet insurance, a comprehensive comparison of different providers is essential. Factors such as monthly premiums, the scope of coverage, reimbursement rates, and the company's reputation for customer service should all play a role in your decision-making process. It may also be worthwhile to seek recommendations from friends, family, or your veterinarian to find a policy that aligns with your financial situation and your pet's needs. In conclusion, while affordable pet insurance can offer valuable protection against high veterinary costs, it's not without its complexities. The key is to thoroughly assess your pet's specific needs and your financial circumstances, ensuring that the policy you choose provides the right balance of cost and coverage. By doing so, you can help ensure that your beloved pet receives the care they need without placing undue strain on your wallet. What does pet insurance typically cover? Most pet insurance plans cover accidents and illnesses, but coverage can extend to wellness care, including vaccinations, dental cleanings, and preventive screenings, depending on the plan. Are pre-existing conditions covered by pet insurance? Generally, pre-existing conditions are not covered by pet insurance policies, making it advisable to enroll your pet when they are young and healthy. How can I find the best pet insurance plan for my pet? To find the best plan, compare different providers based on coverage options, premiums, reimbursement rates, and customer reviews. Recommendations from your veterinarian or fellow pet owners can also be helpful. Is pet insurance worth the cost? The value of pet insurance depends on your financial situation and your pet's health needs. It can provide financial relief and peace of mind, but it's important to weigh the costs against the potential benefits. What should I look for in a pet insurance policy? Look for policies with reasonable premiums, comprehensive coverage, good reimbursement rates, and a reputable provider. Also, read the fine print to understand any exclusions or limitations. https://www.lemonade.com/pet/explained/wisconsin-pet-insurance-guide/

How much does pet insurance cost in Wisconsin? ; Green Bay, $30 to $34 ; Kenosha, $30 to $34 ; Madison, $35 to $39 ; Milwaukee, $35 to $39 ... https://www.forbes.com/advisor/pet-insurance/best-pet-insurance-wisconsin/

How Much Does Pet Insurance Cost in Wisconsin? ... Pet insurance in Wisconsin costs an average of $49 for a dog and $25 per month for a cat, ... https://www.pawlicy.com/pet-insurance-usa/wi/

Costs for Wisconsin pet insurance with unlimited annual maximum coverage ; Domestic Shorthair. 5 years old cat. Milwaukee$16-$34. Green Bay$16-$30. Madison$16- ...

|